Scrooge or savvy? Top 5 tips for chasing outstanding invoices over Christmas

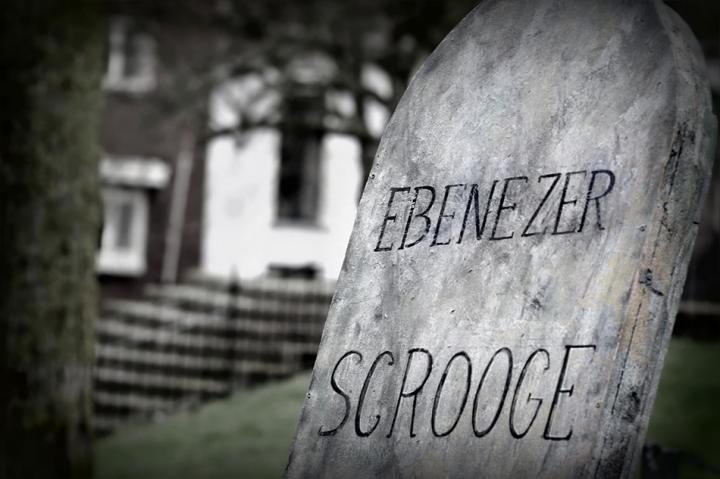

Scrooge, perhaps the most famous debt collector in popular culture and a byword for stinginess, is probably not the Christmas character you want to be associated with over the festive season.

When it comes to debt recovery during December, many businesses are stuck between a rock and a hard place – how do you balance the need to manage outstanding debts and maintain good client relationships without looking like a Scrooge?

1. Write a list and check it twice

Being proactive is good advice any time of year, but particularly at Christmas. A thoughtful approach is essential during this period, as many businesses face cash flow pressures, holiday closures, and a heightened focus on sales. Older debts are harder to collect, so acting quickly is essential, even if you do feel a little awkward about chasing outstanding payments during the holiday season.

Start by making a list of all your outstanding debts and following up on them right away. Reaching out early and setting clear payment deadlines for December helps ensure that clients understand the urgency of settling outstanding balances before they are distracted by Christmas closures. Your customers will likely have multiple creditors and businesses that are proactive with their debt collection and will see their invoices paid first.

2. Don’t be a Grinch

Communications throughout the year should always aim to avoid overly aggressive language so as not to damage client relationships. While results are important, debt recovery is a delicate topic, so it’s important to be empathetic, particularly as Christmas can be a difficult time for many organisations.

You don’t want to alienate a good customer who is experiencing temporary financial difficulties, so don’t let a ‘Grinch who stole Christmas’ approach sour an otherwise good trading relationship.

When you practice good communication, you cultivate healthy relationships, making it easier to anticipate cashflow problems earlier on and use your open line of communication to find a solution that suits both parties.

3. Don’t Ho! Ho! Hold off till New Year

Realistically, not all debt recovery can be completed before Christmas, so it’s wise to plan follow-up efforts for January. Schedule reminders for early January so that you’re on top of your efforts. You might also consider offering a small incentive, such as a discount on early payment, to encourage swift payment in the New Year.

4. The Nightmare Before Christmas

We know that recovering debts before Christmas is a nightmare, so why leave it to December before we start addressing it? Invoice recovery isn’t just for Christmas; it’s an all-year-round activity (even Santa starts planning for next Christmas on Boxing Day).

Having a robust, proactive and consistent invoice recovery strategy that you employ 12 months of the year is the key to protecting your cash flow. Our advice is, therefore, always to try to take back control with a prompt payment policy. If invoice recovery is a part of your process, we find that debtor days are reduced. It’s then easier to manage client expectations from the outset and pass late payment concerns to your debt recovery solution team, saving your business time and money and circumventing difficult conversations.

5. Recruit some helpers

Third-party legal expertise can help recover late payments quickly, efficiently, and, most importantly, compliantly. The right legal team is able to quickly assess outstanding invoices, make recommendations and help you apply for compensation, most importantly, late fees and interest to the debt (where applicable). They’ll seek recovery of your outstanding debts without the heavy-handed approach that risks damaging important client relationships – a key concern for any business chasing payment.

Our team has been recovering debts for thirty years and has ranked top tier in the Legal 500 UK directory for the last eleven. Respect for client relationships is of the utmost importance; we’re known for our personable approach to negotiating successful settlements and for giving pragmatic, strategic advice to anyone who deals with debts, from sole traders to PLCs.

For support and advice on your debt recovery strategy, please contact Colin Churchward on 0191 211 7969 or email [email protected]